The demand for retail space in SoCal’s Inland Empire (IE) market is the strongest it has been since 2007. Rents for new projects are exceeding the pre-recession highs, vacancy continues to decline moderately, cap rates are at historic lows, and national retailers are competing aggressively for the best locations while market fundamentals across the board continue to improve .

The Progressive Real Estate Partners team specializes in the leasing and sale of retail properties in the Inland Empire. Our office has never been busier as we head in the last half of the year and, the GOOD NEWS is, we expect the momentum to continue. Here’s a snapshot of the market trends mid-year:

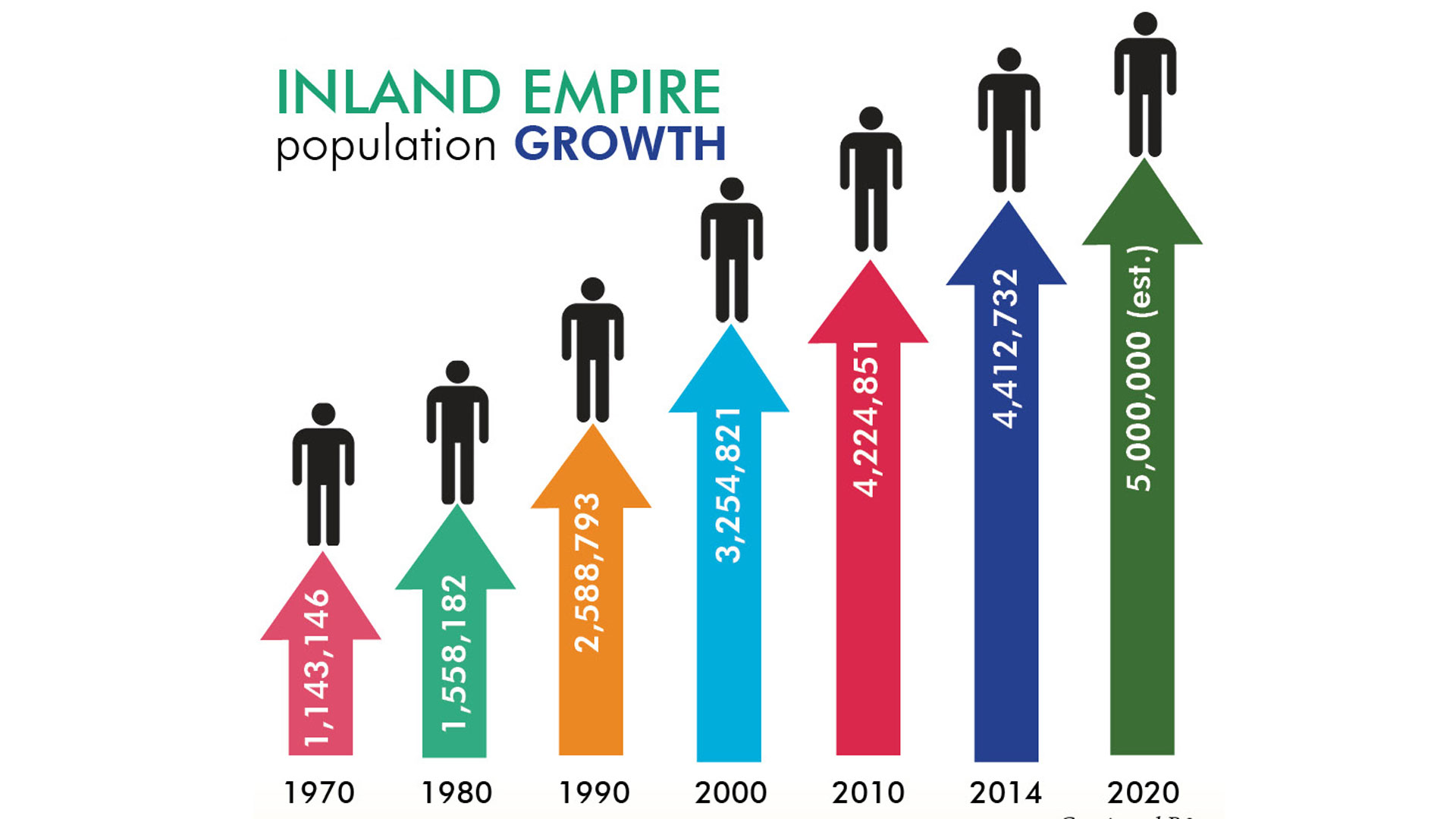

Job and Population Growth Continues to be Robust – The unemployment rate in the IE is down to 5.3% and it’s poised to go even lower by the end of the year. The region is on track to add over 48,000 jobs in 2016 on top of the 50,000-plus jobs added annually in both 2014 and 2015. The Inland Empire also continues to be one of the state’s fastest growing regions in terms of population with 4.5M residents which is projected to grow to 5M by 2020.

Retail Vacancy is Down – Vacancy rates are down to 8% overall from a high of 9.5%. However, it’s important to note that the vacancy rate in newer shopping centers is about 5.4%, which is on a par with 2007 while older properties are at an 8.8% vacancy rate reflecting the strong demand we’re seeing for newer high quality retail properties.

Retail Absorption is UP – In the first six months of the year we saw about 478K square feet of net absorption which is almost as much as ALL of 2015 (500K). There is currently 14.7M square feet of available space to lease. We are experiencing challenges in leasing the last spaces in many centers due to the fact that for every space that gets leased, the universe of potential users goes down because of a variety of factors including the limited number of available uses to lease to, exclusives which prevent leasing to certain uses, and use restrictions from either anchor tenants or city zoning/parking requirements.

Rising Lease Rates – We have signed many leases in the IE at north of $3 per square foot in newer high quality centers. We have also signed many more at rates of $1.25 to $1.75 per square foot in older lesser quality centers which are the rates that these same properties commanded 15 years ago. This huge variance in lease rates makes understanding the marketplace very challenging for all.

Demand for New Retail Construction – An additional 356K of new space was delivered in the first six months of 2016 on top of almost 870K square feet in 2015. There is still room for more new construction as there is significant pent-up demand and stiff competition between retailers for newer “best in class” centers that are well-located and well-anchored.

Retail Sales and New Categories Drive Growth – Retail sales continue to improve and we’re seeing a shift in the types of users that are most active in the marketplace. In this new omni-channel world service, health, beauty, restaurant and entertainment users, all of which benefit from being internet resistant, are filling the space.

Buyer Demand for Retail Properties is Strong – Buyer demand is strong which is reflected in the record low cap rates throughout the IE. Between January and June of this year over 145 properties changed hands representing more than $540M in sales volume at an average price per square foot of $211. This is a reflection of buyer confidence in the marketplace and a substantial amount of capital based in California including foreign capital that has flowed into the market. Corporate and Institutional investors have been very active, however, the IE is also attractive to individual investors that are capable of playing at the highest levels of the investing game. There are currently over 130 retail properties for sale in the region priced between $1M to $40M.

Historic Low Cap Rates – Cap rates have trended lower to an average of 5.8%, but this can be very misleading as newly constructed single tenant properties with long term leases are pushing the average to historic lows. The situation is similar with multi-tenant properties. The challenge is that there are a lot of lesser quality properties where owners are expecting their properties to also sell at record cap rates even though their properties are not as desirable to the investor pool. This is creating a disconnect between buyers and sellers. As a result, investment sales volume for the 1st six months of this year is down about 20% from the same period in 2015.

Attractive Financing Available – Financing for low leverage properties has recently reached historical lows with a number of our clients obtaining 10 year fixed rate money at less than 4%. These rates are generally for higher quality properties with a maximum 60% loan to value ratio. With the proliferation of private lenders, financing is available for just about every type of property. It is just a matter of terms.

Overall there is an abundance of opportunity in both the investment sales and leasing sectors of the market and the region is well positioned to continue to grow and thrive.

Sources: CoStar, Economics & Politics, Inc.,