We all know about the negative impact the pandemic has had on many in the shopping, travel, fitness and restaurant business so I’m not going to reiterate that here. Instead, in this blog I’m going to focus on the actual financial metrics resulting from the related recession on SoCal’s Inland Empire.

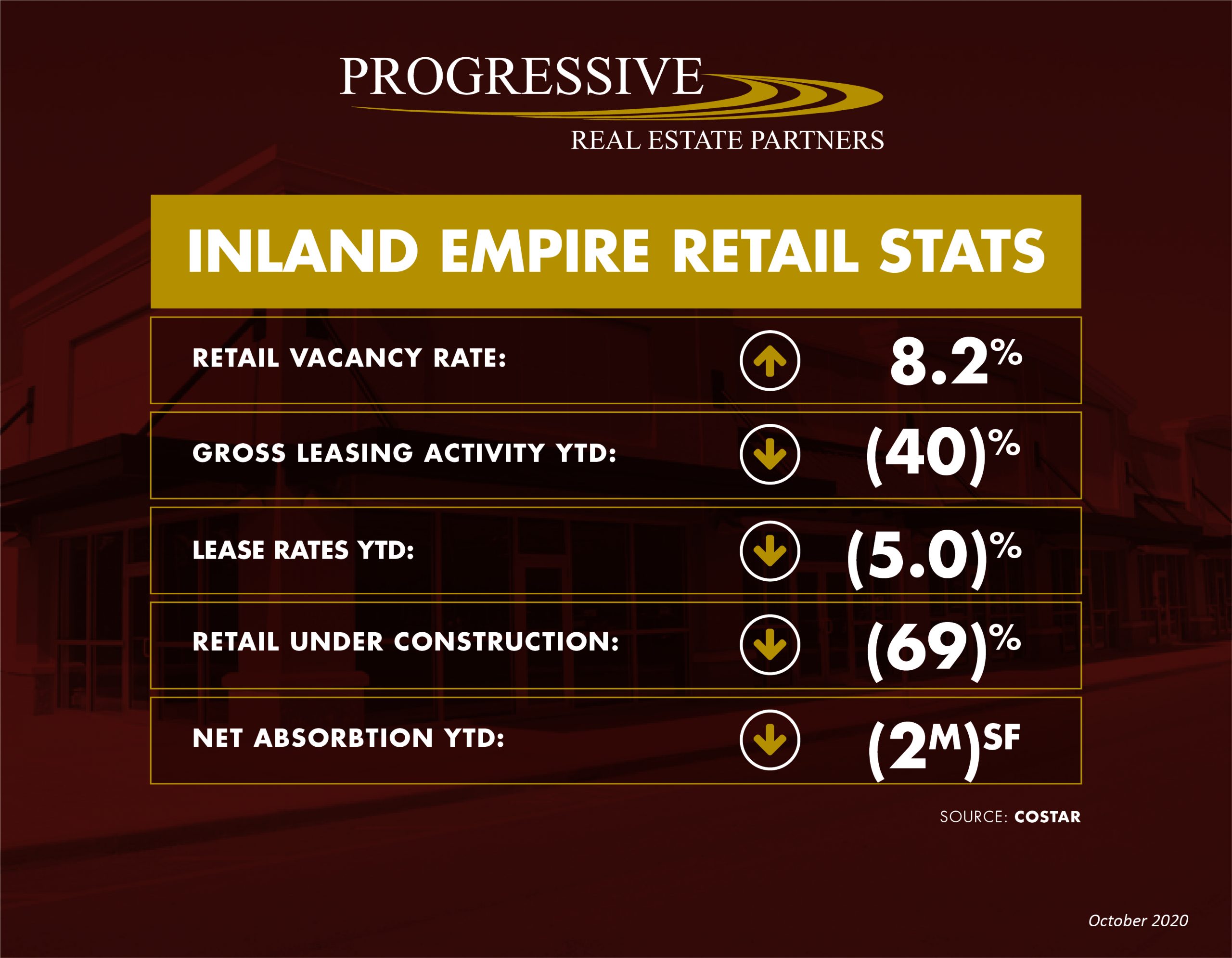

The following are 11 indicators that reflect the current state of the retail leasing market. In the weeks to come I will be sharing similar info on the Investment and land sales markets as well as why I’m still bullish on the Inland Empire over the long haul in spite of the current downturn.

1. 2M Negative Net Absorption: When you take the sum of all the completed leases and subtract spaces that became available over the last year there is a net negative absorption of 2M SF thru September 30th. This is the largest decrease over any 12 month period of time. Much of the square footage that became available includes anchor space relinquished by Nordstrom, 24 Hour Fitness, Sears, Kmart, JC Penney, Bed, Bath & Beyond, Rite Aid, Steinmart, Cinemark, and Vons.

2. Vacancy Increased from 6.8% a Year Ago to 8.2% Today: We went from the best vacancy rate in the past 5 years to the worst in less than a year. According to Costar, there are currently 3,457 spaces available.

3. BUT 46% of the Vacancy is Concentrated in only 220 Spaces: When you drive the market, you don’t see a lot of vacancy. That is because of the 17.4M SF available, 8M SF is concentrated in about 220 spaces that are 15,000 SF or larger. That means 6.3% of the 3,467 spaces available account for 46% of the vacancy!

4. That Puts the Vacancy Rate at 5% for the Balance of the Market: And that feels about right based on what we see when driving the area. This is because, unlike the mid 2000’s cycle which involved a lot of speculative new construction shop space that then took a decade to get absorbed, we started this downturn with very little vacant shop space compared to previous recessions.

5. Retail Leasing Activity on Track to Be Down About 40% from 2019: Leasing activity year to date has been 2.1M SF. It is estimated that 4th quarter leasing activity will account for approximately 500,000 SF resulting in a total of 2.6M square feet leased in 2020. This compares to 4.4M in 2019 amounting to a projected 41% decline in 2020.

6. However 3rd Quarter Leasing Activity Was Up 40% Compared to the 2nd Quarter: From both a square footage and number of transactions perspective, the 3rd quarter recovered about 40% from the 2nd

7. Lease Rates Are Down 5% Since the Start of 2020?: Possibly, but it is really challenging to interpret lease rate data as “apples to apples” comparisons are extremely difficult due to a number of factors:

- The lack of higher lease rate transactions due to the decrease in new construction

- An increase in larger space that leases for lower rates

- Information on tenant improvement dollars and free rent are very difficult to obtain

Therefore, I’m relying on data from completed PREP transaction deal sheets and what our brokers are saying. Based upon this information, lease rates are fairly stable, but tenant improvement allowances are increasing so effective rents may be decreasing.

8. New Construction is Down 69% as Developers & Retailers Pause: From 2017 to 2019, there was an average of 1.3M SF of new retail built annually, but this year we are only at 400K SF year to date. New construction is virtually all “build to suit” activity including a couple of new Grocery Outlets, a Northgate Market, a Cardenas Market, a Costco Business Center, a Sprouts anchored shopping center, single tenant restaurant buildings, and some new car dealerships.

9. Retailers are Looking to the Coastal Markets: This trend happens in every recession. When there is a downturn, retailers want to hold their ammunition to take advantage of potential locations that may come available in Los Angeles and Orange Counties. Retailers recognize the potential of sites we are presenting, but with a limited amount of capital for new stores, they are hesitant to commit to Inland Empire sites compared to other markets that are more difficult to penetrate. Landlords that are willing to provide significant tenant improvement allowances stand a much better chance of getting their space leased.

10. Sit Down Restaurant Spaces Becoming Available: We are starting to see a variety of sit down restaurant spaces of 5,000 SF or more become available as marginal locations are not worth trying to maintain as the pandemic continues. We have recently picked up listings on an Outback Steakhouse, a Wood Grill Buffet, a Sizzler and we anticipate more of these spaces being added to our roster of new leasing opportunities.

11. Car Washes & Service Stations Are Very Active: Despite the substantial decrease in driving, we are seeing significant activity in the car wash and gas station sector. Express Car Wash operators such as Quick N Clean, Fast5Xpress, Super Star, and others are actively looking for new sites. There is also a lot of strength amongst gas station operators looking to purchase existing gas station sites with the goal of redeveloping them into new modern stations. This activity is not just driven by gas sales, but also the substantial volume and profits to be gained by service stations with state of the art convenience stores.

The Progressive Real Estate Partners team recognizes that success is a lot easier in an expanding economy, but our team is doubling down in terms of effort, resources, and working together to maximize the retail leasing results for our clients.

If we can be of service to you, please reach out to me at brad@progressiverep.com or on my cell at 909-816-4884. We wish all of our reader’s good health and expanding wealth!