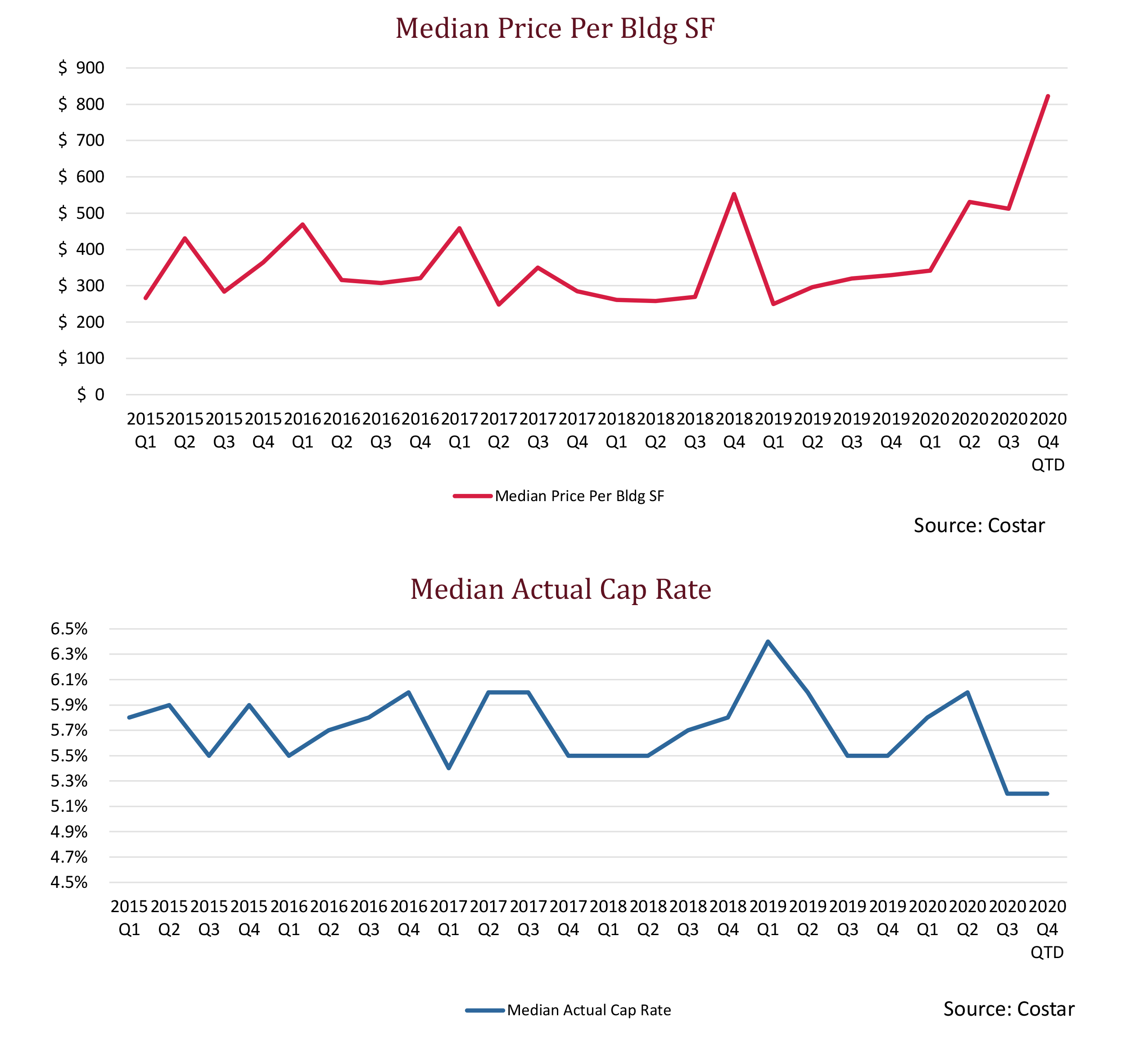

Below are two charts. The top one shows the average price per square foot for retail properties that have recently sold in Southern California’s Inland Empire. The bottom one shows the cap rates for these same properties.

If you had no context other than these charts, most people would say that this is a booming market. They might even say that this is an investment bubble that is about to burst. But we have context and, as a result, we understand what is really happening.

Unfortunately, the retail investment sales market is NOT booming. Instead there has been a massive shift in buying activity. Since the pandemic began, the market for multi-tenant investment properties has virtually disappeared. Here are some facts regarding the Inland Empire investment sales market since April 1, 2020.

- No properties over $10,000,000 have sold;

- Only 54 properties over $1,000,000 have sold;

- 21% of the sales were multi-tenant properties;

- 79% were single tenant properties;

- 9 properties sold for more than $1,000/SF!

- 41 properties sold below a 6% cap rate

Here is what’s actually happening:

- The market has shifted with a much greater weight toward single tenant properties.

- Single tenant properties generally sell for much lower cap rates and much higher prices per square foot compared to multi-tenant properties.

- The pool of properties that make up the data set has gone down by over 50% compared to the same period last year.

Although the current situation is an extreme aberration and may be obvious to certain investors, it demonstrates the importance of working with brokers that truly understand the region and the market fundamentals.

At Progressive Real Estate Partners, we take a lot of pride in staying abreast of the current market conditions so our clients can make informed decisions. We welcome the opportunity to help you understand the investment sales opportunities and achieve your retail real estate goals. Feel free to reach out to me at brad@progressiverep.com.