In addition to Progressive Real Estate Partner’s primary focus on the retail real estate market in Southern California’s Inland Empire, we continue to expand our presence to the Eastern San Gabriel Valley (605 Freeway east toward the Los Angeles County line). As a result, I have combined data from this marketplace with the Inland Empire statistics. I may break out this info in the future, however, in my opinion the Eastern San Gabriel Valley functions similarly to the Western Inland Empire so combining the two areas affects the data very minimally.

The following are some raw numbers from CoStar as we sit halfway through 2024 (See Graphs Below):

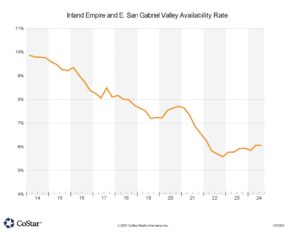

The Availability Rate is 6.1% and generally stable. The Availability Rate includes both vacant space and space that is being marketed but is still occupied. Because we are seeing more and more leases being completed before a space even becomes vacant, we are realizing that looking at the Availability Rate is a better indicator than the Vacancy Rate.

Leasing Activity was 2.4M SF Year to Date. Leasing activity has been very consistent for the past 7 quarters, ranging from a low of 1.13M to a high of 1.30M square feet.

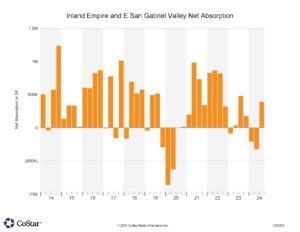

Net Absorption Was Negative 528K SF for the first half of 2024. Absorption is total leased minus newly vacant. Much of the cause for this negative absorption relates to the 99 Cent Only and Rite Aid stores that hit the market in the first half of this year.

427,000 SF of Newly Constructed Space was Delivered in the First Half of 2024. We prefer looking at Space Deliveries vs. Under Construction. We find that the latter can be very misleading. For example, if a site is designed for a 100,000 SF retail center and only 2 pad buildings totaling 6,000 SF are under construction, it is not unusual for Costar to include all 100,000 SF as under construction. Deliveries are more precise.

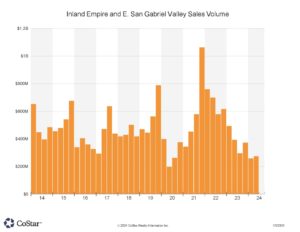

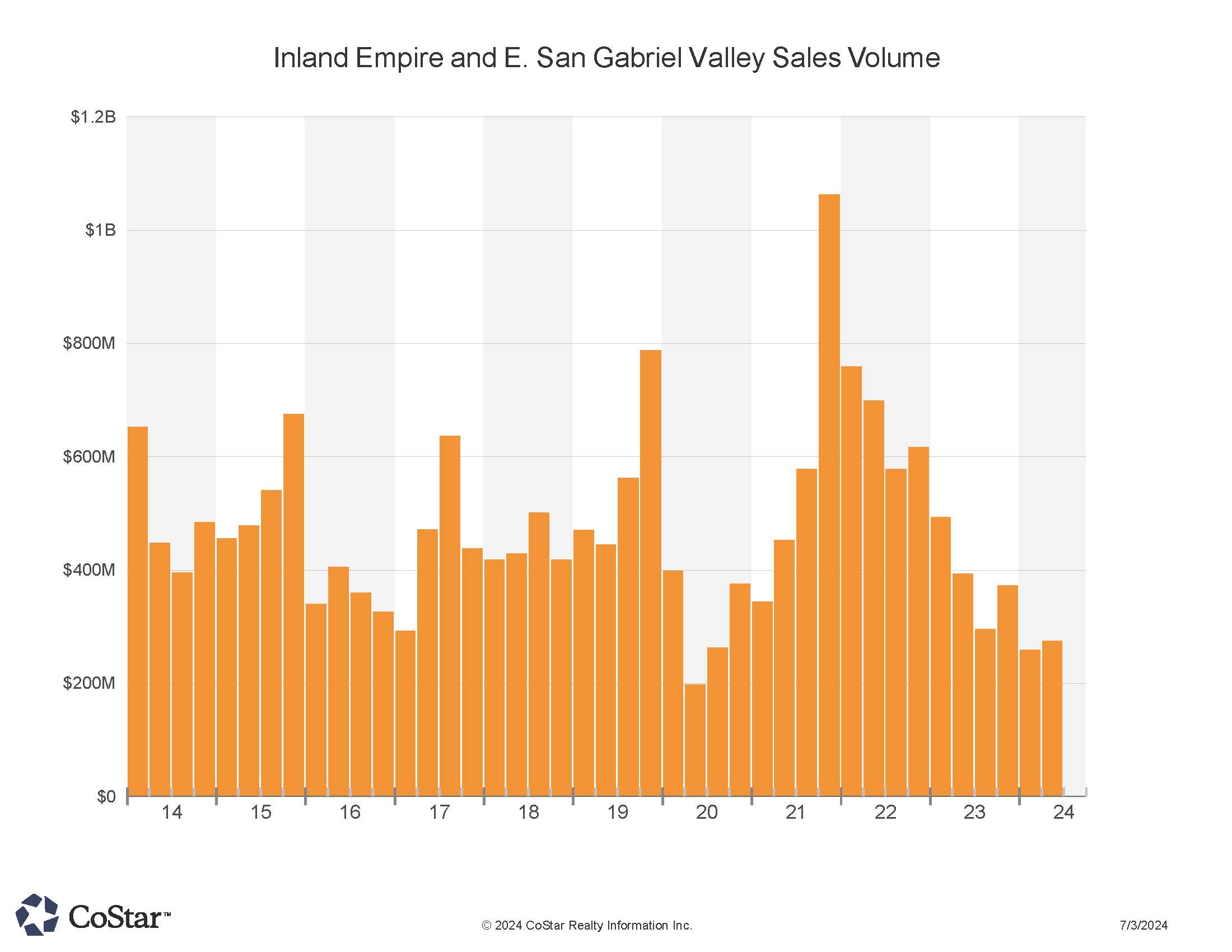

Sale Volume was $532M Year to Date. Sales volume has stopped decreasing and is likely moving higher as more owners are electing to meet the market and transact.

Now that I have covered some facts & figures, I want to offer some “boots on the ground” commentary:

Sales Activity Will Likely Increase When Short Term Rates Decrease: Many people think that sales activity will be tied to long term rates, but I don’t believe we are going to see long term interest rates come down much. What I do foresee is that short term rates will decrease. We are currently hearing from many investors something like, “why should I buy a property at a 6% cap rate” when I am earning over 5% risk free in treasuries and my money market account.” Never mind that the investor is foregoing depreciation and potential appreciation with this argument. It seems that once the reward for sitting on cash decreases, it will prompt buyers to pursue the depreciation and potential appreciation that they know they are currently foregoing.

Lots of Demand for the 99 Cent Only Portfolio: I have never seen anything like what is currently occurring relative to the 99 Cent Only portfolio of properties they vacated. In the past, if something like this had occurred, it could be years before most of the portfolio was absorbed. But between Dollar Tree taking almost half the space and the interest from users like Grocery Outlet, Smart & Final, Planet Fitness, the revived Pic N Sav, and others, this portfolio is getting a lot of attention and I believe that at least half of the space that Dollar Tree did not assume will be leased before year-end.

Restaurants Are Vacating, but Also in High Demand: With the substantial increase in the cost of labor restaurants are evaluating each of their locations and not renewing leases under select circumstances. Despite this fact, the number of restaurants that are aggressively looking to take over failed restaurant locations is extremely high. The benefits of taking over a previous restaurant site include substantial cost savings due to existing infrastructure including equipment, the knowledge that the parking demands of the restaurant are allowed, the likelihood that the sale of beer, wine & liquor will be permitted, and the increased speed of processing building plans for such sites. I think the next few years will see a much higher amount of restaurant space turning over compared to the historical amounts.

The November Election May Not Be a Factor: It seems that people are so disgusted with the process and choices that most people are tuning out the election process as a part of their decision making. We are hearing from some owners and tenants that they are waiting to see who will be elected before making decisions, but overall, I think people are starting not to care. It seems like as individuals we are on one side of the playoffs waiting to see who we will face in the next round. But when we analyze the two teams we might face, people are deciding that it does not really matter because successful businesspeople know that they can win under either playoff scenario.

Summary:

Leasing activity in the Inland Empire and the Eastern San Gabriel Valley markets remains strong and looking ahead we expect sales activity will improve once short-term interest rates start to decline. The Progressive Real Estate Partners team is committed to consistently providing our clients with the most up-to-date market data so they can respond effectively to opportunities. This blog is just one of the many ways we keep our clients informed. As always, feel free to reach out to me at brad@progressiverep.com with any questions or observations.