Today’s retail real estate market in SoCal’s Inland Empire fascinates me. In my 30+ year career and as President of Progressive Real Estate Partners, I believe this may be the fundamentally strongest market that I have seen. And yet when you speak to all the different players, the narrative might make you think otherwise. The difference in perception is based upon what your position is in the market:

- Landlords are generally pretty content right now.

- Landlord leasing brokers are pleased with their ability to get spaces leased, but they are constantly needing to replenish their pipeline.

- Tenant rep brokers are challenged due to the lack of quality space and the competition for such space.

- Developers struggle with achieving the necessary rents to make a project pencil and the uncertainty of lease rates and exit cap rates. Plus, the 10% rate on construction financing and the uncertainty of construction costs adds to the challenges.

- Investment sale brokers are scrambling to make sure they are listing properties that will sell with sellers who want to meet the market.

- Retailers are mostly making money, but they are facing rising costs, tight labor markets and in some cases the threat of increased regulation.

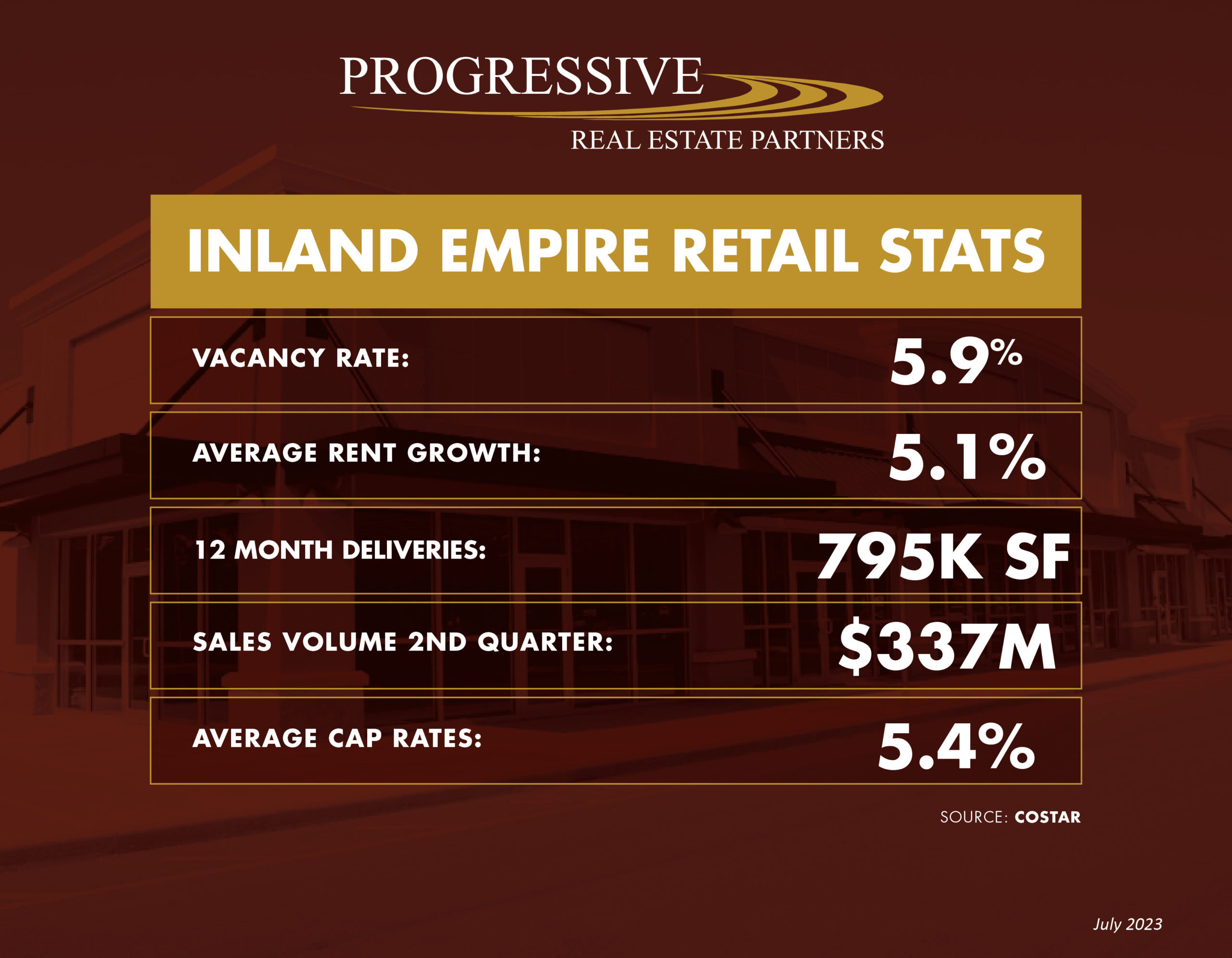

Below I present the Inland Empire’s 2nd quarter 2023 data including my interpretation:

Vacancy:

- The retail vacancy rate for the entire market is 5.9% which equates to 11.9M square feet of retail space.

- Out of a pool of 17,600 properties, there are 100 “special” properties that have 20,000 SF of contiguous space or larger. The total square feet available in these buildings is 4.7M square feet.

- If you subtract out these spaces, there is 7.2M square feet available which drops the vacancy rate to 3.9%.

- As a result, it is easy to see why tenant rep brokers are indicating that they are struggling to find quality retail space for their clients.

Rents:

Ultimately retail rents should be a reflection of operator sales. Generally, the higher the sales the higher the rent they can pay. There is a caveat that certain users have higher margins than others which does skew the previous statement.

In general operators are trying to balance three major expenses:

- Cost of goods

- Personnel

- Rent

At this time, none of these are going down. Most tenants are also raising their prices. Therefore the combination of a lack of vacancy and the desire for tenant expansion is allowing rents to go higher.

The Progressive Real Estate Partners leasing team is definitely achieving higher lease rates across our portfolio, especially for quality spaces:

- The range of rents for the highest quality non-drive thru spaces are $3.00/SF, plus NNN charges up to $4.00/SF.

- Many inline shop spaces in mature, but quality retail centers are leasing at $2.25/SF to $3.00/SF rents.

- Anchor and sub-anchor spaces are leasing for between $1.00 to $1.50/SF range.

Discussing retail rent averages is difficult because of the uniqueness of each property, space, etc. BUT anecdotally, there is little doubt that rents continue to climb.

The question is at what point is there enough resistance to price increases whereby either cost of goods, personnel, or rents will have to bear the brunt of an operator’s ability to stay in business or expand.

New Construction:

- According to Costar there was 655K SF of retail space delivered over the past 12 months. The Costco in Murrieta was 23% of this amount.

- The remaining 500K SF is comprised of about 150 projects which demonstrates that most new buildings are less than 5,000 SF.

- Anecdotally, some of the tenants that are occupying these new buildings included Sprouts, Stater Bros., 99 Ranch, Aldi, Dollar General, Dollar Tree, The Learning Experience, O’Reilly Auto Parts, Chick Fil-A, Chipotle, AutoZone, Starbucks, Dutch Bros., The Habit Burger, McDonald’s, Sherwin Williams, Wendy’s, Taco Bell, Jack in the Box, Popeyes, and numerous gas stations and express car washes.

- Currently, the largest projects under construction include Lewis Retail Centers Stater Bros. anchored centers in Ontario and Chino as well as the Target anchored center known as The Shops at Jurupa Valley which will also include EOS Fitness, Burlington, Ross, Aldi, In N Out, and many others.

Investment Sales Volume & Cap Rates:

- There was $337M of retail properties that changed hands in the Inland Empire in the 2nd quarter of 2023.

- This is 20% below the average quarterly volume over the past 10 years and 43% below the average quarterly volume of 2021 & 2022.

- Approximately 66% of this activity was NOT investment sales, but instead owner/user activity including the sale of businesses that included the real estate.

- In a market that includes 201M SF of retail space, only 273K SF of investment property traded!

- The average cap rate for the investment properties was 5.4%.

- The average cap rate for the 10 strip centers that sold was 6.23%.

- The average cap rate for the 15 single tenant properties that sold was 4.72% which included 6 ground leased properties. Tenants within these properties mostly included nationally recognized publicly traded tenants including Dollar General, McDonald’s, Bank of America, Sherwin Williams, 7-Eleven, Dutch Bros., Jack in the Box, Starbucks, McDonald’s & CVS.

Some of the key factors affecting sales volume are:

- Owners enjoying cash flow as a result of low vacancy, rising rental rates and low loan rates that they locked in over the past 5 years.

- Buyers being bombarded with mixed information and the penalty for a lack of action is earning a risk-free 5% return in US Treasuries.

- The challenge of obtaining financing at favorable leverage and interest rates.

- Owner perception that interest rates may go down and therefore improve the value of their property.

- Economic uncertainty.

In conclusion:

- The fundamentals of the retail market are very positive.

- Development activity appears to be increasing as the only way for certain users to grow is to pay for ground up construction.

- Although the investment sales market is not functioning efficiently at this time, and I’m not sure what will cause it to adjust, I am confident that the number of buyers and sellers will increase in the not too distant future.

Based upon the above information, I think you can see why I find this market so fascinating. I always welcome your feedback and would appreciate hearing your questions or perspective. Feel free to reach out to me at brad@progressiverep.com or at 909-230-4500.