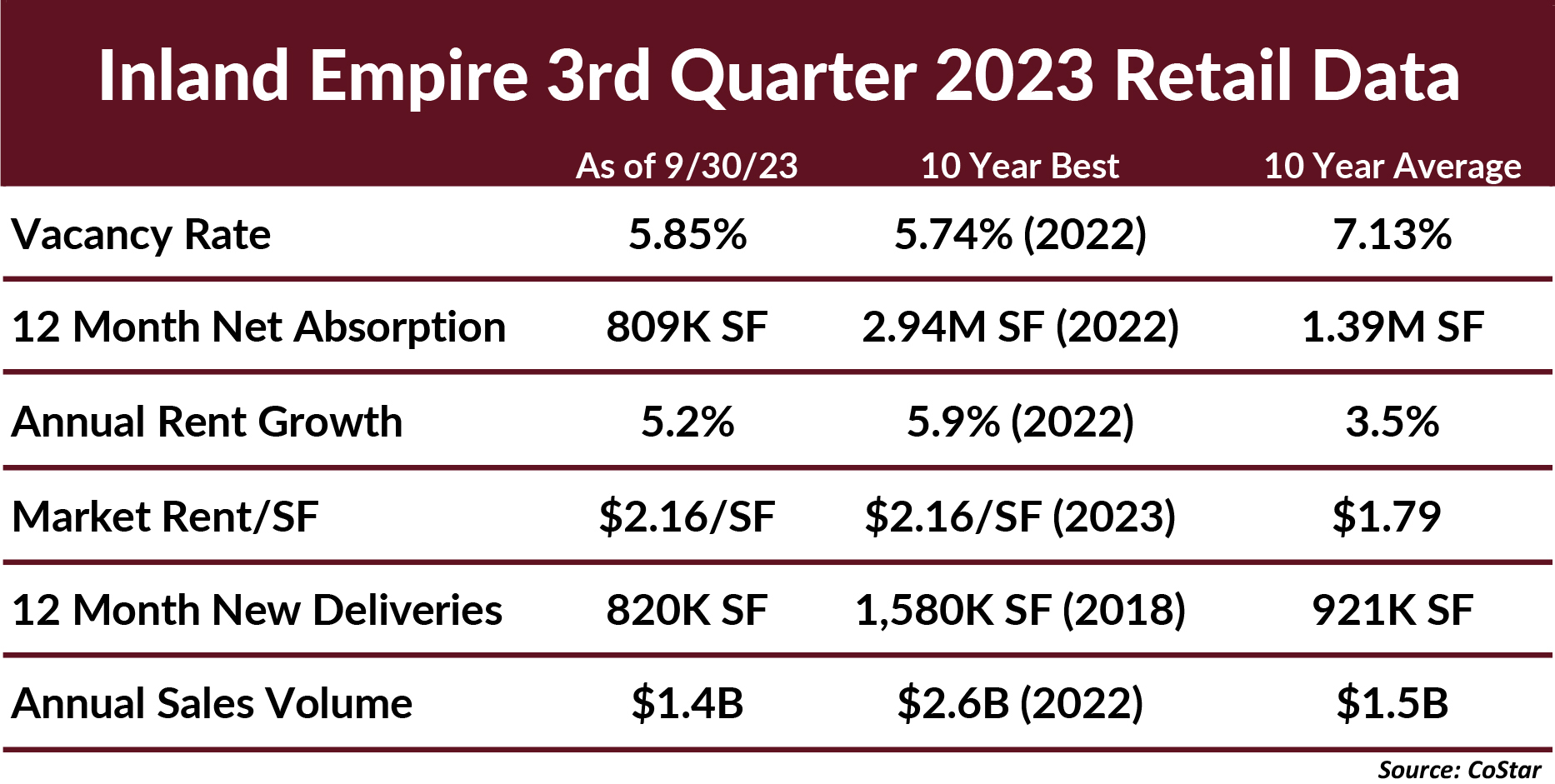

After reviewing the 3rd quarter 2023 stats for SoCal’s Inland Empire retail real estate market, it’s clear we’re still enjoying a favorable market BUT I realize how one interprets the information largely depends on their perspective. Included in this graph is the most recent data compared to the 10-year “average” and 10-year “best” stats.

Clearly each situation is unique but for illustrative purposes, let’s look at the data from the perspective of a Landlord, Leasing Broker, Seller, Buyer, Developer, Tenant and lastly my thoughts (cue read til end). These perspectives are based upon what the Progressive Real Estate Partners’ team has been hearing over the past few months.

Landlord

- It’s great to finally have some leverage with tenants.

- I am trying to keep my triple net charges down, but my insurance rates increased a lot this past year and so did trash costs. I am concerned about many of my other expenses because they are labor based and labor costs seem to continue to rise for the type of workers who do maintenance and repair work.

- My tenants should be able to pay the higher rent since so many of them, especially the restaurant tenants, have raised their prices so much during this past year.

Leasing Broker

- It feels like I just keep leasing myself out of a job.

- I need to maintain inventory.

- My clients are being choosier regarding what tenant they will accept. I remember there were times when landlords accommodated any tenant that could fog a mirror.

Seller

- My property was a 5% cap rate in 2021 and now you are telling me it is a 6% cap rate. I will wait.

- I know I should consider selling after all the vacancies that I have had during the past decade, but now I am fully leased and I want to enjoy the cash flow.

- What will I buy? (Note: No matter what the market conditions, this is the number one question sellers ask).

- I don’t have to sell. I can just refinance (usually said by someone who has not explored the lending market yet).

- (From the motivated seller) I don’t like the price, but I want to sell so let’s get it done.

Buyer

- The cap rate should be much higher. I just received a 7.0% loan quote.

- I want to buy something, but I also don’t want to make a mistake.

- Let’s push for buying the property with the best fundamentals even if that results in a lower cap rate. I am in this for the long term and with fewer buyers, I want to make sure I get a good piece of property.

Developer

- This recession is killing our business.

- Higher financing costs, lower construction loan leverage, higher construction costs, and higher cap rates make it almost impossible to make a profit. I am focusing on only those deals where I really believe I can make money.

- Tenants need to pay more rent to make anything pencil!

Tenant

- Rents and NNN charges are too high.

- There is too much competition for quality space.

- All of my costs are going up and we can’t keep raising prices.

- We won’t go non-contingent until we have dotted the last “I” and crossed the last “t”.

Investment Broker

- We are working twice as hard for less money. It seems that most deals are going in and out of escrow at least once or twice before it closes.

- There is still a large discrepancy between what most buyers will pay and where most sellers will sell. The market is challenged to find price equilibrium.

- It is time to return to the fundamentals of brokerage. Make those calls!

The Head Coach of PREP (This is my perspective)

- I think we are in a new paradigm whereby most of the Inland Empire retail real estate market will function more like an infill marketplace with very little new development, more redevelopment, lower vacancy rates, and a requirement that brokers be more creative to create value.

- There is so much opportunity as the region continues to grow and we are excited to be a part of this growth and capture the opportunities that it presents our clients.

- Although we can’t control the market, we can control our own actions. I am very proud of the PREP team because they have maintained a consistent work ethic throughout this year and we continue to excel in our marketplace.

Conclusion

As you can see, the same set of facts can create wildly different perspectives depending upon your role. I really enjoy this time in the brokerage business because it tests everyone’s skill set and the PREP team is looking forward to a productive 4th Quarter and continuing to help our clients achieve their goals.

I would love to hear your perspective and always welcome your feedback. If you have questions or comments I encourage you to reach out to me at brad@progressiverep.com or at 909.230.4500.